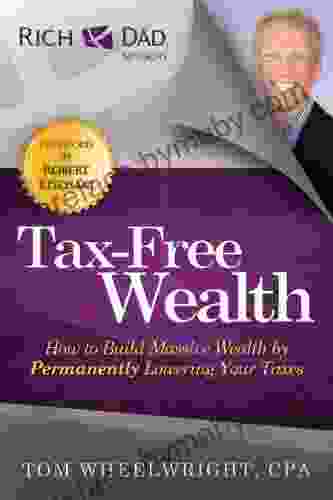

Unlock Financial Abundance: How to Permanently Lower Your Taxes and Build Massive Wealth

Embrace the Secrets of Tax Optimization with Rich Dad Advisors

In the realm of financial success, one truth holds true: the power of tax optimization. By embracing proven strategies to minimize your tax liability, you can unlock a new level of financial freedom and wealth accumulation. Enter "How To Build Massive Wealth By Permanently Lowering Your Taxes," a comprehensive guide co-authored by Robert Kiyosaki and the experts at Rich Dad Advisors.

This groundbreaking book is a roadmap to navigating the complex world of taxes, empowering you with the knowledge and tools to make informed decisions that maximize your wealth. Armed with the wisdom contained within its pages, you'll learn:

4.6 out of 5

| Language | : | English |

| File size | : | 6230 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 353 pages |

1. The Tax Code is Not the Enemy

Uncover the misconceptions and fear surrounding the tax code. Understand that it can actually be a powerful ally in your wealth-building journey.

2. Legitimate Tax Loopholes and Deductions

Explore a vast array of legal and ethical strategies that can significantly reduce your tax liability. From real estate investments to business deductions, discover the loopholes that the wealthy utilize.

3. Tax Planning for Different Income Levels

Learn how to optimize your tax strategy based on your income level. Whether you're a high-earner or just starting out, there are tailored strategies to suit your financial situation.

4. The Power of Retirement Accounts

Leverage the tax advantages of retirement accounts, such as 401(k)s and IRAs. Discover how these accounts can help you save for the future while minimizing current tax burdens.

5. Tax-Efficient Investments

Make informed investment choices that maximize your returns while minimizing taxes. Learn about dividend-paying stocks, municipal bonds, and other investments designed to shelter your wealth from unnecessary taxation.

6. Tax-Friendly Business Structures

Explore how the choice of business structure can dramatically impact your tax liability. From LLCs and S corporations to C corporations and trusts, discover the optimal structure for your unique circumstances.

7. The Importance of Partnerships and Joint Ventures

Learn how strategic partnerships and joint ventures can help you share expenses and reduce tax liabilities. Understand the legal and financial implications of these arrangements.

8. Estate Planning for Tax Mitigation

Safeguard your assets and minimize estate taxes through effective estate planning strategies. Learn how to pass on your wealth to loved ones while minimizing the impact of taxation.

9. The Psychology of Tax Planning

Understand the mindset shift required for successful tax optimization. Overcome the fear of audits and embrace a proactive approach to managing your finances.

10. Case Studies and Real-Life Examples

Witness the transformative power of tax optimization firsthand through real-life case studies and examples. Learn from the experiences of those who have successfully implemented these strategies.

"How To Build Massive Wealth By Permanently Lowering Your Taxes" is an indispensable tool for anyone seeking financial freedom and wealth accumulation. By embracing the principles outlined in this book, you'll gain the knowledge and confidence to minimize your tax liability, leaving you with more resources to grow your wealth and secure your financial future. Join the ranks of the financially elite by purchasing your copy today and unlocking the power of tax optimization.

4.6 out of 5

| Language | : | English |

| File size | : | 6230 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 353 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Emma Child

Emma Child Julie Ertz

Julie Ertz Eric Seale

Eric Seale Noah Wood

Noah Wood Eliza Raine

Eliza Raine Eric Leiser

Eric Leiser Matthew Pearl

Matthew Pearl Michael T Murdock

Michael T Murdock Ellen Meiksins Wood

Ellen Meiksins Wood Emma Rae Parker

Emma Rae Parker Elliot S Maggin

Elliot S Maggin Stephanie Wood

Stephanie Wood Elmar Neveling

Elmar Neveling Elizabeth Hope

Elizabeth Hope Panos Y Papalambros

Panos Y Papalambros Emma Chichester Clark

Emma Chichester Clark Sophie D Coe

Sophie D Coe W Chan Kim

W Chan Kim Eric Bieller

Eric Bieller Von Allan

Von Allan

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Miguel de Cervantes50 Best Tailwaters to Fly Fish: An Angler's Guide to World-Class Trout...

Miguel de Cervantes50 Best Tailwaters to Fly Fish: An Angler's Guide to World-Class Trout... Edward BellFollow ·12k

Edward BellFollow ·12k Robin PowellFollow ·2.4k

Robin PowellFollow ·2.4k Bobby HowardFollow ·11.4k

Bobby HowardFollow ·11.4k Ernest PowellFollow ·9.8k

Ernest PowellFollow ·9.8k Bret MitchellFollow ·19.4k

Bret MitchellFollow ·19.4k Bruce SnyderFollow ·3.2k

Bruce SnyderFollow ·3.2k Jaden CoxFollow ·19.7k

Jaden CoxFollow ·19.7k Stanley BellFollow ·18.4k

Stanley BellFollow ·18.4k

Richard Adams

Richard AdamsGame Development with Rust and WebAssembly: A...

Are you passionate...

David Baldacci

David BaldacciGendered Identity and Aspiration on the Globalized Shop...

: The Convergence of Gender, Identity, and...

Natsume Sōseki

Natsume SōsekiFresh Eyes On Panama: A Captivating Exploration of a...

Panama, a country often overshadowed by its...

Adrian Ward

Adrian WardThe Life and Masterworks of J.M.W. Turner: A Timeless...

The Man Behind the Masterpieces ...

4.6 out of 5

| Language | : | English |

| File size | : | 6230 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 353 pages |