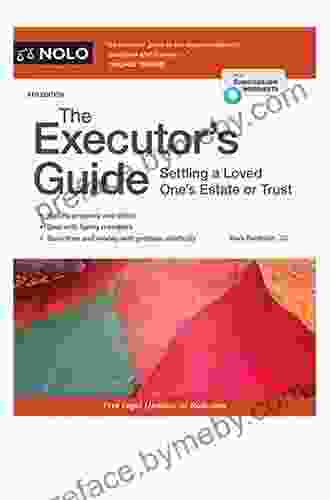

Settling Loved One Estate Or Trust: A Comprehensive Guide

The loss of a loved one is a deeply emotional and challenging time. In addition to grieving, you may also be faced with the task of settling their estate or trust. This can be a complex and overwhelming process, but it's important to approach it with care and attention to detail to ensure that the deceased's wishes are respected and their assets are distributed fairly.

4.6 out of 5

| Language | : | English |

| File size | : | 9921 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 529 pages |

Step-by-Step Instructions

- Obtain a copy of the will or trust. This is the most important document in the estate settlement process, and it outlines the deceased's instructions for the distribution of their assets. If there is no will or trust, the estate will be distributed according to state law.

- Appoint an executor or trustee. The executor or trustee is responsible for managing the estate and carrying out the deceased's wishes as outlined in the will or trust. This person should be someone who is trustworthy, organized, and capable of handling the legal and financial aspects of the estate.

- Inventory the assets and debts. This includes all of the deceased's property, such as real estate, vehicles, stocks, and bonds, as well as any outstanding debts, such as mortgages, credit card bills, and medical expenses.

- Pay the debts and taxes. The executor or trustee must pay off any outstanding debts and taxes before the assets can be distributed to the beneficiaries. This may require selling some of the deceased's assets.

- Distribute the assets. Once the debts and taxes have been paid, the remaining assets can be distributed to the beneficiaries according to the instructions in the will or trust. This may involve selling the assets and distributing the proceeds, or transferring the assets directly to the beneficiaries.

Expert Advice

- Seek professional help from an attorney or accountant. An experienced attorney or accountant can help you navigate the legal and financial complexities of settling an estate or trust. They can also assist with tax planning and estate administration.

- Communicate with the beneficiaries. It's important to keep the beneficiaries informed throughout the estate settlement process. This will help to avoid misunderstandings and conflicts.

- Be patient and organized. Settling an estate or trust can take time, so it's important to be patient and organized throughout the process. Keep track of all paperwork and deadlines, and don't hesitate to ask for help when needed.

Practical Tips

- Start the process as soon as possible. The sooner you start the estate settlement process, the sooner you can close out the estate and distribute the assets to the beneficiaries.

- Delegate tasks to others. If you're overwhelmed with the estate settlement process, don't be afraid to delegate tasks to others, such as family members, friends, or a professional estate administrator.

- Keep detailed records. Throughout the estate settlement process, it's important to keep detailed records of all financial transactions, communications with beneficiaries, and other relevant documents.

Settling a loved one's estate or trust can be a challenging and emotional process, but it's also an important one. By following these step-by-step instructions, expert advice, and practical tips, you can navigate the process with confidence and ease, ensuring that the deceased's wishes are respected and their assets are distributed fairly.

Remember, you're not alone in this process. There are many resources available to help you, including attorneys, accountants, estate administrators, and family and friends. Don't hesitate to seek help when needed, and always put the deceased's wishes first.

4.6 out of 5

| Language | : | English |

| File size | : | 9921 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 529 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Frances Dinkelspiel

Frances Dinkelspiel Emma Bland Smith

Emma Bland Smith Lucas Keys

Lucas Keys Emily M Leonard

Emily M Leonard Paul Rosenberg

Paul Rosenberg Eric P Lane

Eric P Lane Emily Harris Adams

Emily Harris Adams Ephraim Mattos

Ephraim Mattos Eric B Taylor

Eric B Taylor Rick Revelle

Rick Revelle Emily Crafts

Emily Crafts Julia Galef

Julia Galef Kyla Stone

Kyla Stone Emma Cartwright

Emma Cartwright Ellie Krieger

Ellie Krieger Eleanor Roosevelt

Eleanor Roosevelt Emily Alison

Emily Alison Richard Schechner

Richard Schechner Keith Giffen

Keith Giffen Rachelle Nelson

Rachelle Nelson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

William FaulknerThe Power, Purpose, and Prayer of Ballet Technique: A Guide to Unlocking...

William FaulknerThe Power, Purpose, and Prayer of Ballet Technique: A Guide to Unlocking... Gabriel Garcia MarquezFollow ·14.3k

Gabriel Garcia MarquezFollow ·14.3k Julio Ramón RibeyroFollow ·16.4k

Julio Ramón RibeyroFollow ·16.4k Jamie BellFollow ·8.6k

Jamie BellFollow ·8.6k Ashton ReedFollow ·4.7k

Ashton ReedFollow ·4.7k Shane BlairFollow ·13.2k

Shane BlairFollow ·13.2k Ron BlairFollow ·14.5k

Ron BlairFollow ·14.5k Luke BlairFollow ·11.9k

Luke BlairFollow ·11.9k Marc FosterFollow ·2.2k

Marc FosterFollow ·2.2k

Richard Adams

Richard AdamsGame Development with Rust and WebAssembly: A...

Are you passionate...

David Baldacci

David BaldacciGendered Identity and Aspiration on the Globalized Shop...

: The Convergence of Gender, Identity, and...

Natsume Sōseki

Natsume SōsekiFresh Eyes On Panama: A Captivating Exploration of a...

Panama, a country often overshadowed by its...

Adrian Ward

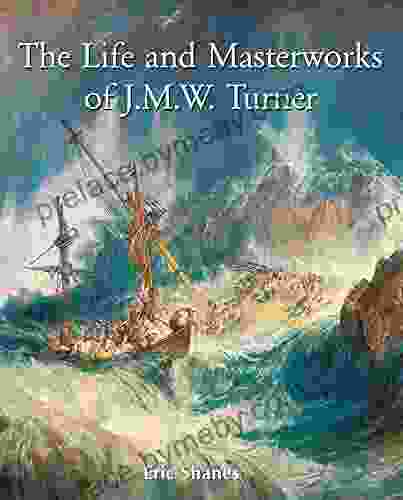

Adrian WardThe Life and Masterworks of J.M.W. Turner: A Timeless...

The Man Behind the Masterpieces ...

4.6 out of 5

| Language | : | English |

| File size | : | 9921 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 529 pages |